Our Impact

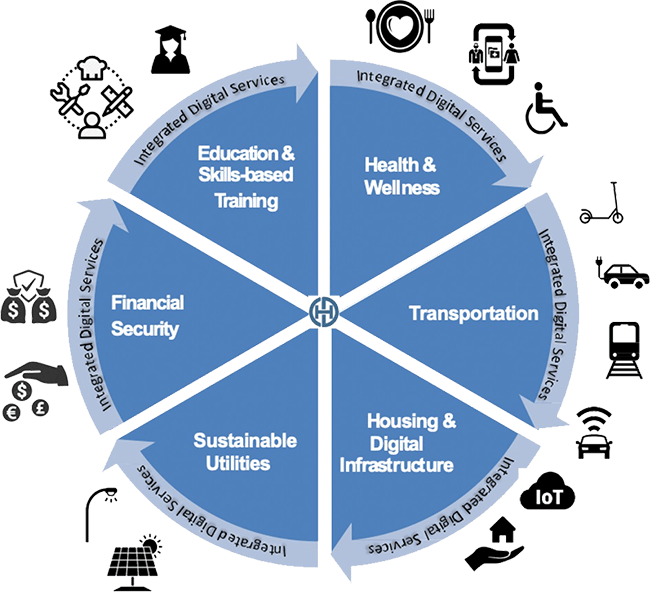

The current pandemic has brought global societal challenges into forefront and as governments make plans to rebuild economies and livelihoods, Human Capital Development has been uniquely positioned to collaborate with public and private sector partners in building strong and vibrant economies through an inter-disciplinary approach to tackling the entrenched social challenges. Our social impact investments have and will continue to be in public private partnerships that have important socio-economic implications in sectors such as nutritional food security, renewable energy security, affordable housing, transportation and healthcare, and education.

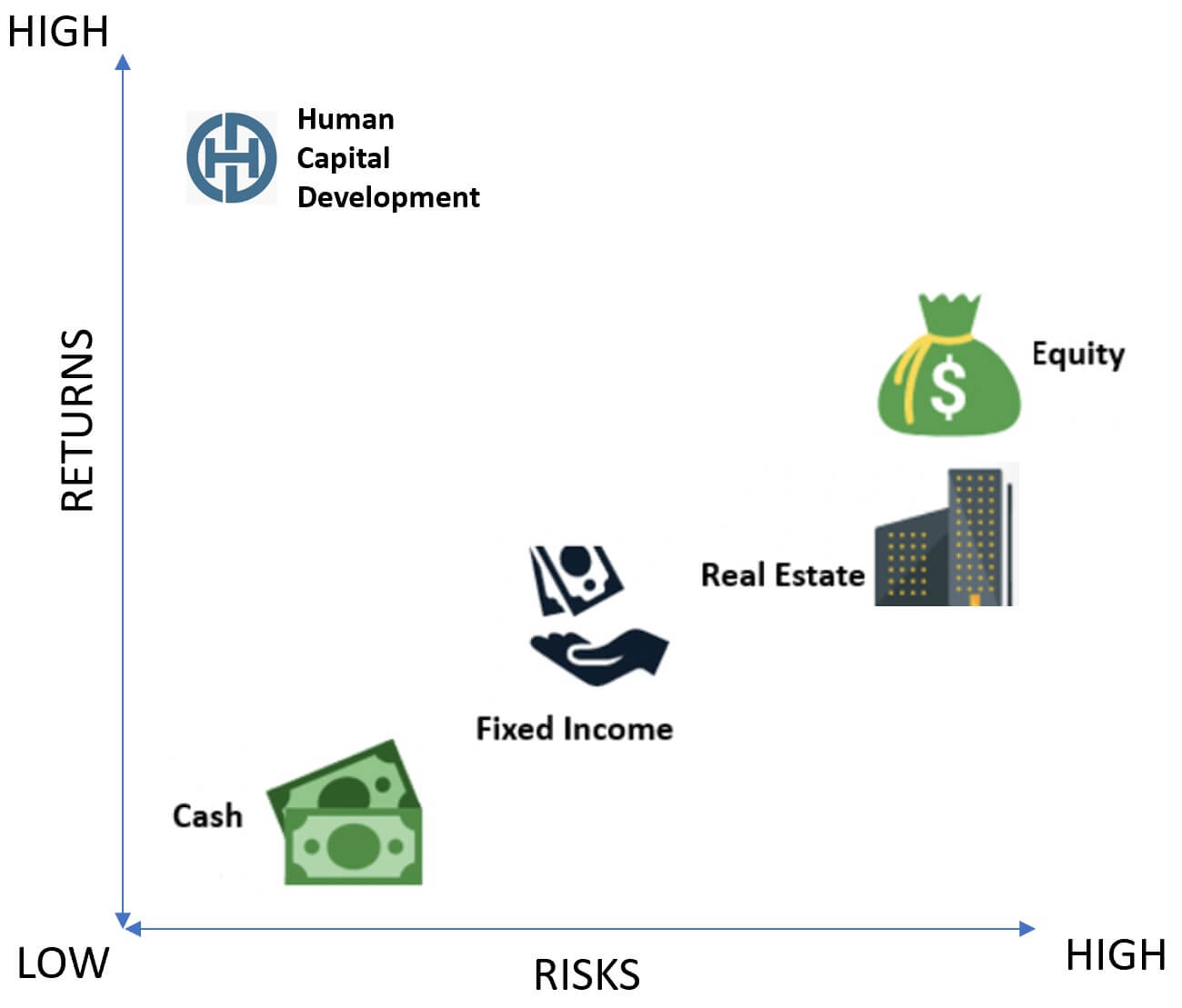

We have been working diligently on institutionalizing impact investments in human capital development as an alternative asset class. As such, we analyze the questions one would ask when adding impact investments to an investment portfolio. Our Human Capital Development is an alternative and separate asset class that is no longer defined simply by the nature of its underlying assets, but rather by how institutional investors organize themselves around it.

Specifically, our new asset class has the following characteristics:

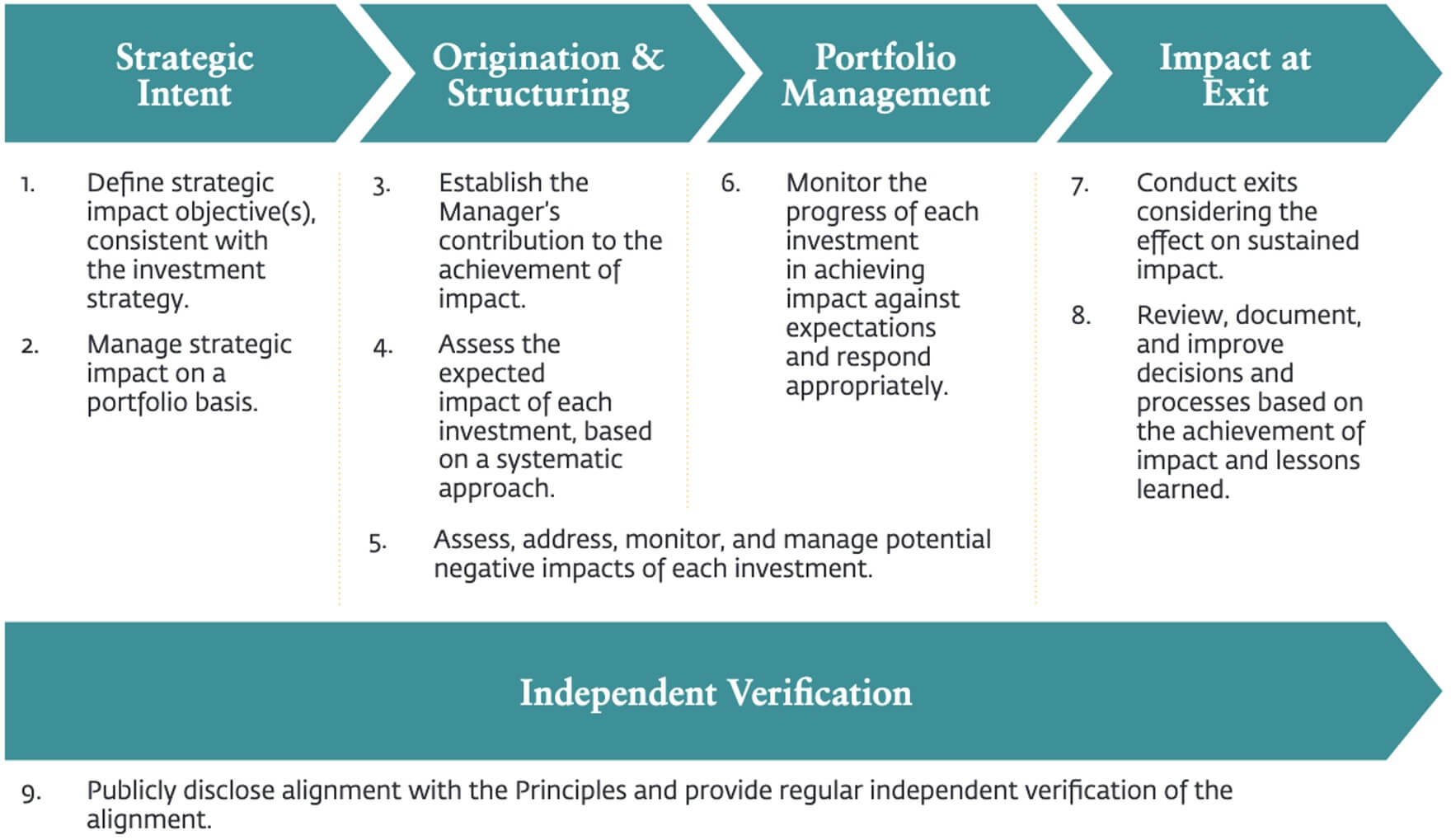

OUR HUMAN CAPITAL DEVELOPMENT ASSET CLASS INVESTMENT PRINCIPLES

The elements are: strategy, origination and structuring, portfolio management, exit, and independent verification. Within each of these five main elements, the Investment Principles have been defined by a heading, supplemented by a short descriptive text. In total, the 9 Principles that fall under these five main elements are considered the key building blocks for a robust asset class management system.

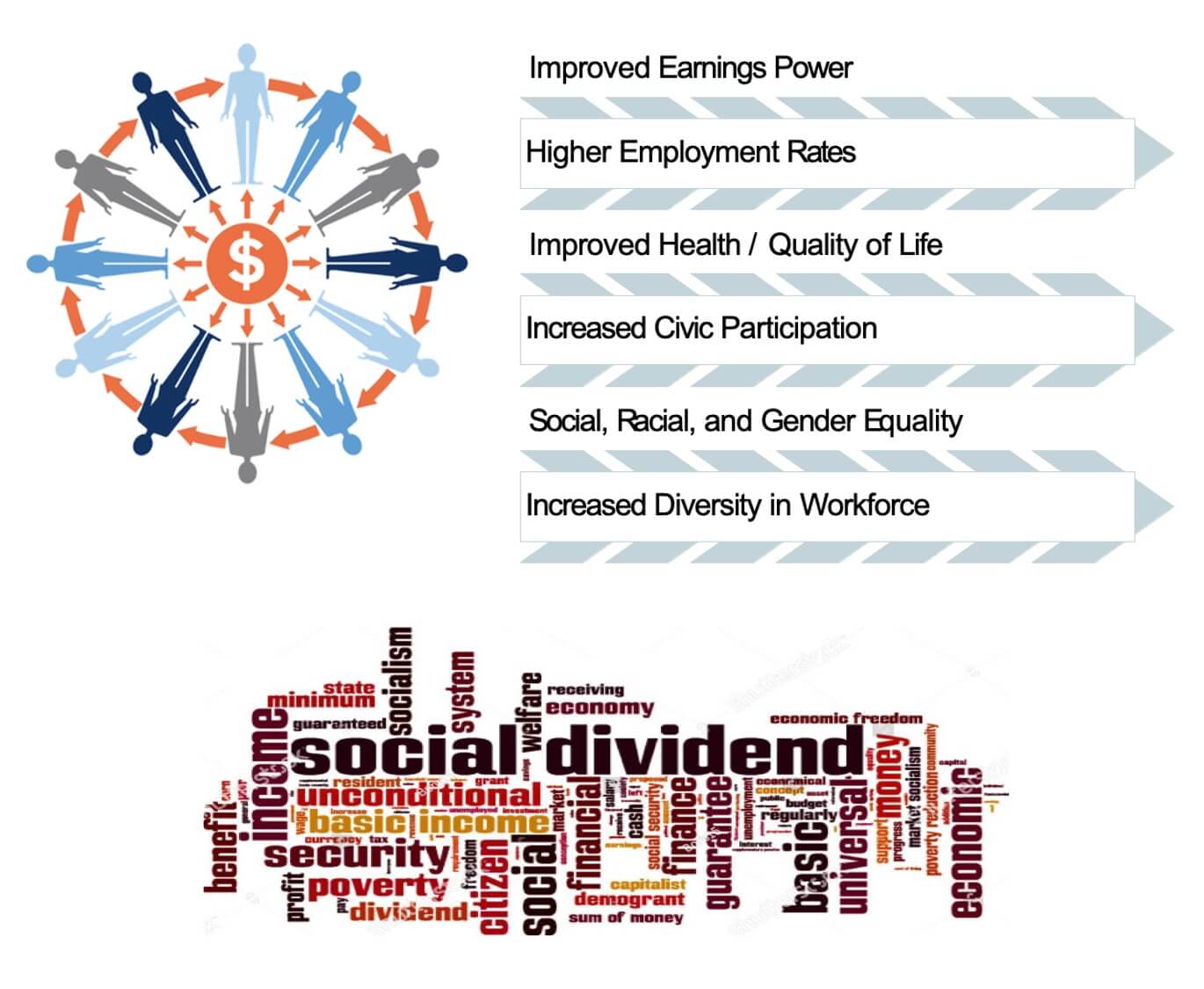

Our continued efforts are towards the creation of financial accounts that reflect our company’s financial, and social impact performance. We are creating accounting statements that transparently capture external impacts in a way that drives investor and managerial decision making:

Massive environmental damage, growing income and wealth disparity, stress, and depression within economies amid a substantial economic boom are examples of how our current system of creating and distributing value is broken. We need to be able to factor into our decision-making the consequences of our actions not only for financial and physical capital but also for human, social and natural capital. In the same way that accounting standards define which financial transactions to capture and how to account for them within financial statements, our accounting methodology reveals our firm’s overall value to society through its impact. Creating a GAAP and IFRS analogue for impact accounting pertaining to human capital development would generate benefits: transparency, comparability, accountability.

As reimagining capitalism is an imperative, we have been working towards creation of a more inclusive and sustainable form of capitalism that works for every person and our planet.